|

Data fields

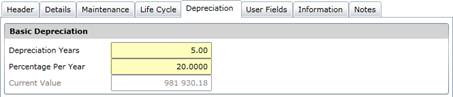

These data fields are captured or displayed on the Asset - Depreciation tab.

|

Field |

Description/Setting |

|

Basic Depreciation |

Only applicable if the Basic Depreciation model is used to depreciate Assets. |

|

Depreciation Years |

The period of depreciation, specified in years, is calculated automatically if the Percentage per Year is entered first. If the depreciation period is 5 years then the Percentage Per Year is calculated as 20% using the straight-line depreciation rule. |

|

Percentage per Year |

The percentage rate at which the Asset is depreciated is calculated automatically if the Depreciation Years is entered first. If the Percentage Per Year is entered as 20% then a 5-year Depreciation Years is calculated using the straight-line depreciation rule. |

|

Current Value |

The current value of the Basic Depreciation model for the Asset after depreciation is calculated using the Purchase Amount on the Asset - Maintenance tab, the Commissioned On Date on the Asset - Life Cycle tab, and Percentage Per Year or Depreciation Years. The formula is: Purchase Amount * [(Depreciation Years*365) - (Commissioned Date / (Depreciation Years*365)] |